Form 1099-NEC vs. 1099-MISC for Tax Year 2020

The year is wrapping up and we can’t say that we’ll be sad to see 2020 go! However, before you begin planning your virtual Christmas parties, let’s talk about your...

The 2020 Instructions for Forms 1094-C and 1095-C

Here is a guide to navigating the changes to these forms.

The Latest Guidance on the Paycheck Protection Program

Here is what small businesses seeking loan forgiveness must know.

Drafts of Form 943, 944 and 940 are Now Available with COVID-19 Changes

To ease the stress of figuring out these new drafts, TaxBandits is breaking them down for you!

The IRS Released Another Updated Draft of Form 941-X

Here is the latest update from the IRS on Form 941-X, The Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

A Closer Look at the Employee Social Security Tax Deferment

Here is a quick guide to navigating this payroll tax deferral and reporting it for the 3rd quarter.

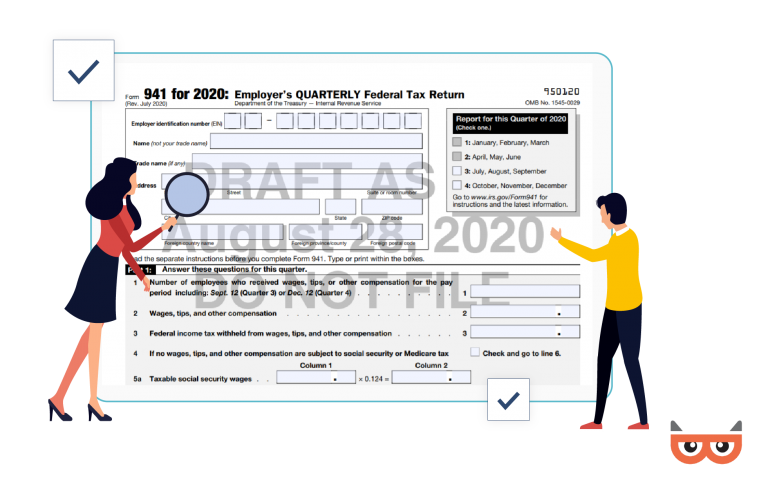

What You Need To Know Before Filing for the Third Quarter

You may have heard that the IRS has released another revised draft of Form 941 for Q3.

Form 941 Is Revised Yet Again For The Third Quarter Of 2020

The IRS has released a draft of Form 941 for the 3rd Quarter of 2020. Here's what employers need to know: