Proposed IRS Changes to E-filing Requirements could Impact your Business

Businesses will soon be required to e-file the majority of their information returns!

The IRS Released A New Draft of Form 941 and Worksheets for the Second Quarter of 2021

How will the new draft affect filing for Q2 of 2021?

The Colonial Pipeline Shutdown May Impact Your Business Operations

How your business can be proactive.

3 Reasons TaxBandits is your Small Business Tax Filing Solution

Check out how we can serve your business this tax season and beyond!

How To Support Small Businesses Despite The Coronavirus

As the efforts to stave off the Coronavirus ramp up, small businesses seem to be suffering the most financially. As the CDC recommends that we practice social distancing and stay...

Didn’t Receive Your Form W-2? Here’s What You Need To Know

January 31st is the deadline for employers to provide copies of Form W-2 to their employees. If the deadline passes and you still haven’t received your Form W-2, there are...

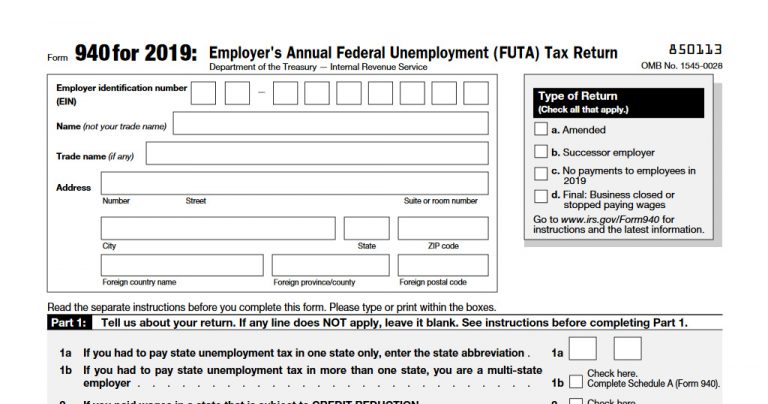

Changes to IRS Form 940 You Need To Know

The only people who can handle change are coin collectors, sociopaths and the IRS. Of course, it’s possible for one person to be all three, but who hates themself that...