Year-end E-filing Requirements for Kansas

Reporting wages and certain payments with the State of Kansas.

What you need to know about FUTA Taxes and Form 940

Paying and reporting in accordance with the Federal Unemployment Tax Act.

Year-end E-filing Requirements for Louisiana

Reporting wages and certain payments with the State of Louisiana.

Year-end E-filing Requirements for Kentucky

Reporting wages and certain payments to the State of Kentucky.

5 Reasons Why TaxBandits is your 1099 Solution this Year

Tax Season is upon us and the deadlines for many IRS forms are less than two weeks away. These deadlines include Form W2, Form 1099, Form 941, and Form 940...

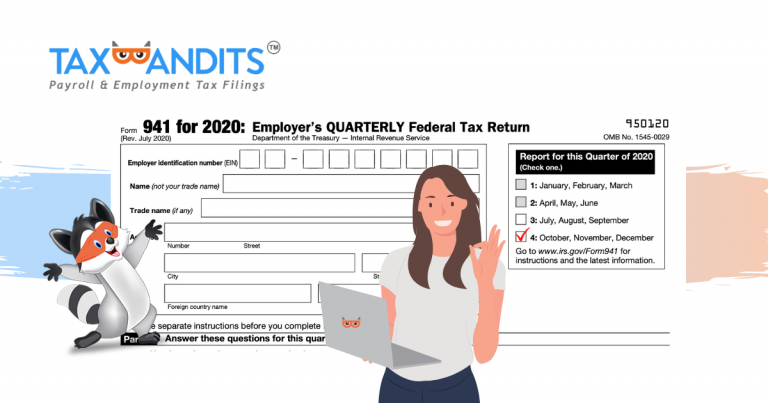

E-filing your Form 941 for the Fourth Quarter of 2020

Year-end filing is at the forefront of every employer’s mind right now. In addition to the deadlines for Form 1099-NEC and Form W-2, employers must also complete their Employer’s Quarterly...